Beyond the headline net zero commitments and frequently reoccurring climate platitudes, reducing carbon emissions in line with global targets will require some seriously heavy lifting, particularly by companies with long histories of traditional energy generation.

In the case of MVV, a German regional integrated utility, and Utilitas, the largest district heating operator in Estonia, the roadmap for net zero greenhouse gas emissions is multifaceted and comprises significant technical and technological renewal as well as cultural change.

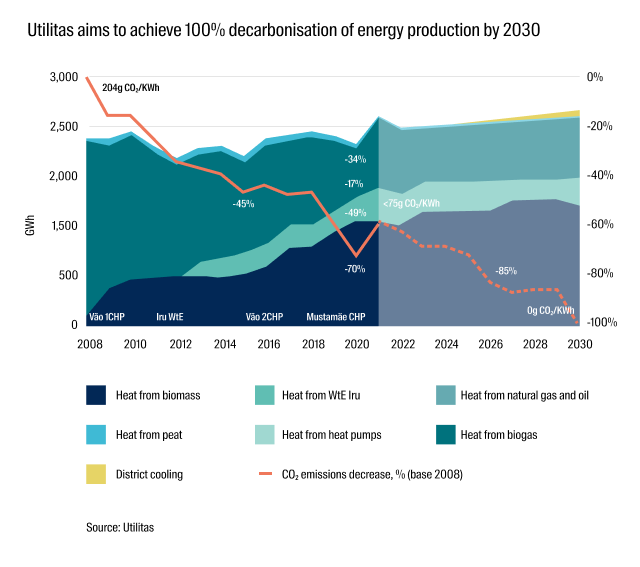

In the 13 years to the end of 2021, Utilitas, which operates three combined heat and power and now nine solar parks to heat 174,000 households in Eastern Europe, has invested more than €400 million to drive down its reliance on greenhouse gas emitting energy. During this time the company has replaced natural gas and oil-fired energy production with new biomass-fuelled combined heat and power plants as well as sourced waste heat from a nearby energy-from-waste plant.

Utilitas is one of the 17 companies in Igneo Infrastructure Partners’ portfolio of 25 that have set a net zero emissions target .

To meet its commitment, Utilitas has estimated it will spend an additional €550 million on a series of programs to upgrade energy production and infrastructure to improve efficiency, secure green electricity supply with the construction of two renewable energy projects, and implement digital solutions to reduce consumption peaks which saves energy.

Plans are already in place at the district heating operator to install sea and wastewater heat pumps, invest in new and more efficient pumps, replace natural gas production with biogas, construct new onshore wind and solar projects as well as introduce smart substations to enable real-time automatic management of the networks.

The acquisitions of MVV and enfinium were the primary source of the increase in total scope 1 and 2 emissions from 2020 to 2021

The plans and capital earmarked for Utilitas’s transformation are among the more detailed in the group of 25 companies, but emblematic of what sits behind a commitment to net zero.

Igneo is aiming for all of its portfolio companies to have in place by 2023 a long-term goal for achieving net-zero emissions by 2050 or earlier. Portfolio companies should also articulate short and medium-term emissions reduction targets.

Reducing emissions, not avoiding them

Setting a net zero target doesn’t necessarily mean just investing in companies with low carbon intensity

Setting a net zero target doesn't necessarily mean just investing in companies with low carbon intensity. In fact Igneo measured an increase in its portfolio’s carbon footprint in 2021 compared to the previous year. The firm measures its portfolio’s carbon footprint using the weighted average of tonnes of scope 1 and scope 2 CO2e emissions of its portfolio companies per million Euros of net asset value.

Igneo attributes the increase in its portfolio’s carbon footprint during the 12 months to 2021 to acquisitions of relatively high emitting businesses, enfinium and MVV.

Source: Igneo Infrastructure Partners

Mannheim-headquartered MVV Energie is a good example of the approach Igneo takes working with companies despite exposure some other investment firms might consider to be a ‘show stopper’ such as coal power generation, as highlighted in this recent insight.

Like many regional utilities in Germany, MVV looks back on a history of over 100 years and has traditionally relied on conventional fossil fuels to generate power and heat for its customers. MVV’s total carbon footprint is dominated by its Scope 1 emissions from gas and coal-fired co-generation plants.

After months of detailed planning, in October 2021, MVV published a new target to reach net zero by 2040, a decade ahead of the timeline Igneo places on its portfolio companies as part of its ‘Climate Action 1, 2, 3!’ program. The company has also committed to interim goals including reducing Scope 1 emissions by 80% by 2030 and reducing Scope 2 and 3 emissions by 80% by 2035, both against a 2018 baseline.

Beyond 2040, MVV plans to become climate positive, removing carbon from the atmosphere by sequestering it at its biomass and energy-from- waste plants.

MVV’s roadmap to its ambitious net zero goals include commissioning a new natural gas plant in Kiel to replace an old coal plant, upgrading an energy-from-waste plant in Mannheim supporting the city’s district heating network and providing incremental capacity to allow gradual decommissioning of Mannheim’s major coal plant. It also has on its roadmap the opening a new energy-from-waste plant in Dundee, Scotland, as well as renewal of an older energy-from-waste plant that had been earmarked for decommissioning.

Important information

All data sources are independently verified and can be evidenced by Igneo Infrastructure Partners.

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should consider, with the assistance of a financial advisor, your individual investment needs, objectives and financial situation.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change.

To the extent this material contains any expression of opinion or forward looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at Igneo Infrastructure Partners or First Sentier Group.

About First Sentier Group

References to 'we', 'us' or 'our' are references to Igneo Infrastructure Partners or First Sentier Group (as applicable). First Sentier Group is a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group. Igneo Infrastructure Partners is an unlisted infrastructure asset management business and is part of the First Sentier Group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) RE Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 240550; ABN 13 006 464 428)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson's Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors and Igneo Infrastructure Partners are business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B) and Igneo Infrastructure Partners (registration number 53447928J) are business divisions of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors International IM Limited, authorised and regulated by the Financial Conduct Authority (reg. no. SC079063, reg office 23 St Andrew Square, Edinburgh, Scotland, EH2 1BB)

- United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (RIA 801#93167)

- Other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© Igneo Infrastructure Partners