Why invest in Direct Infrastructure?

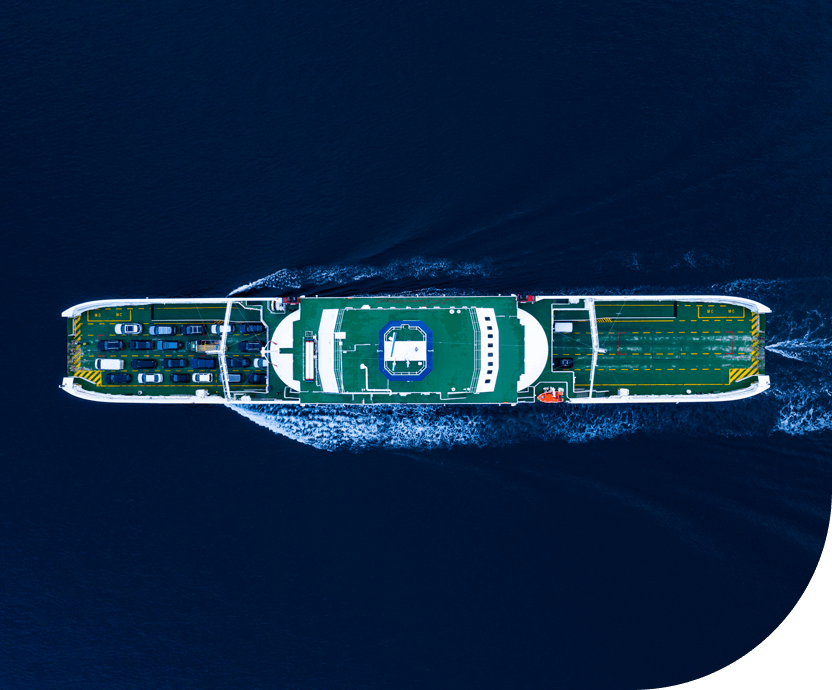

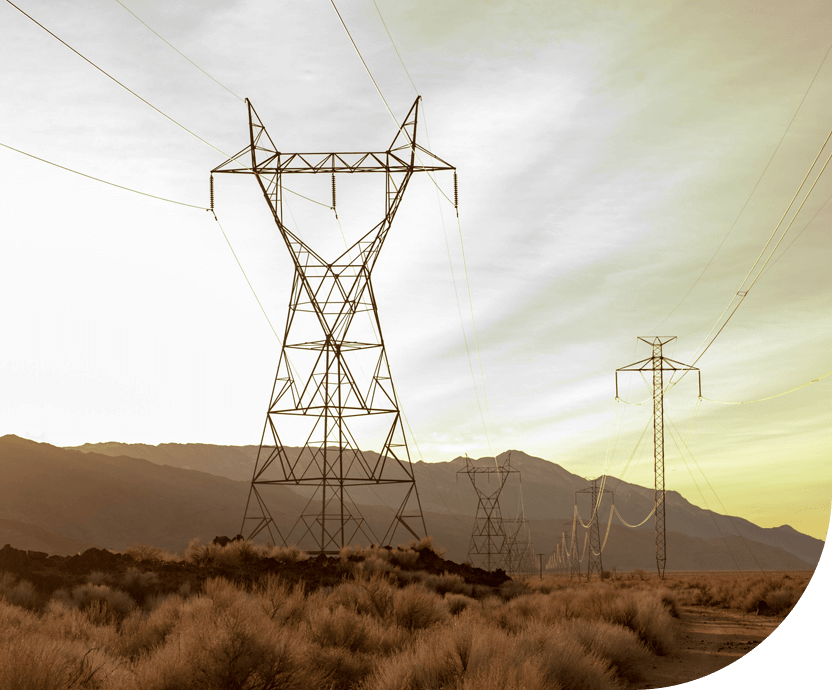

Infrastructure is essential to the smooth functioning of any modern society. Access to clean drinking water, efficient and effective sanitation and waste management, distribution and supply of energy, modern telecommunications, transportation, travel and trade, all depend on the provision and operation of high-quality infrastructure.

We define infrastructure as fixed assets that facilitate the provision of essential services, or transportation of essential commodities, to communities and economies.

The nature of these assets and the features of the markets in which they typically operate means that infrastructure assets offer many or all of the following characteristics:

Source: * 'Guide to Alternatives'. Correlation coefficient with global bonds & equities 2008-2020, JP Morgan, August 2020

Strategies we offer

Igneo Infrastructure Partners, part of First Sentier Group, is one of the longest established investors in infrastructure assets. We have been investing in this asset class for more than 30 years. We are one of the leading infrastructure asset managers worldwide with unrivalled experience managing global infrastructure assets for a breadth of investors.

infrastructure assets managed*

*as at 31 December 2025 (US$) excluding undrawn commitments, First Sentier Group

continual investment in this asset class

Our pedigree is built on

Experience

As active infrastructure investors for almost 30 years, we have managed assets across geographic regions, industrial sectors and throughout economic cycles

Value enhancement

Usually we are either 100% owners, or lead shareholders, in the businesses we invest in. This gives us the governance required to allow us to engage proactively with our portfolio companies to create sustainable long term value.

Responsible investment

We have a genuinely long-term perspective and have held some of our assets for more than 25 years. This buy and hold philosophy uniquely allows us to create sustainable value. We do this through the application of our proactive asset management approach over the long term

Team

With a long standing senior team and over 65 investment professionals worldwide, we have one of the largest pools of investment expertise with which to source, evaluate, invest and monitor investments

As active infrastructure investors for almost 30 years, we have managed assets across geographic regions, industrial sectors and throughout economic cycles

Usually we are either 100% owners, or lead shareholders, in the businesses we invest in. This gives us the governance required to allow us to engage proactively with our portfolio companies to create sustainable long term value.

We have a genuinely long-term perspective and have held some of our assets for more than 25 years. This buy and hold philosophy uniquely allows us to create sustainable value. We do this through the application of our proactive asset management approach over the long term

With a long standing senior team and over 65 investment professionals worldwide, we have one of the largest pools of investment expertise with which to source, evaluate, invest and monitor investments

View our portfolio assets

To view the assets currently held across our portfolios, please click the link below: