Unlocking growth in European Infrastructure for over 30 years

At Igneo, we drive value creation in the businesses we acquire through strategic investment, global insight, and hands-on partnership.

With 30+ years middle-market expertise, our proactive management approach offers attractive risk-adjusted returns for our clients.

Target sectors

Scandlines' journey to zero emissions

Scandlines is the sole operator of the Rodby-Puttgarden (RoPu) and Gedser-Rostock (GeRo) ferry routes, connecting Denmark with Germany. RoPu is the fastest route between Copenhagen and Hamburg and a 120km shorter driving distance than the next viable alternative. GeRo is the fastest route between Copenhagen/Southern Sweden and Berlin, which is 2-3 hours quicker than low-frequency ferries from Sweden.

"12 minutes is phenomenal. I think any of us, if we were even charging a car in 12 minutes, would be impressed. To charge a whole ferry in 12 minutes is something else."

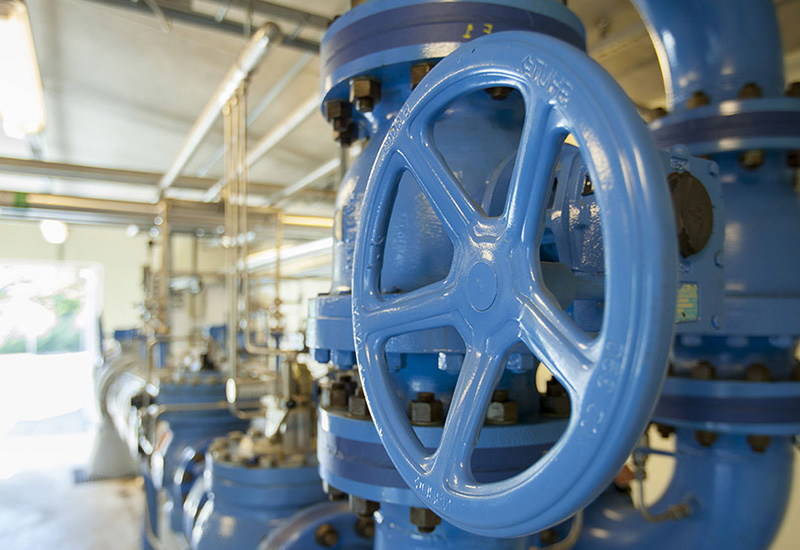

Nordion Energi's path to green energy

Nordion Energi was formed through the integration of three acquisitions; Swedegas (2018), Weum Gas (2018) and Falbygdens Energi (2021). The activities of the company include the ownership and operation of the sole gas transmission network in Sweden, located in the south-western part of the country (Swedegas), the country’s largest gas distribution network, mainly in the Malmo metropolitan area (Weum Gas), as well as the electricity distribution network of Falkoping (Falbygdens Energi). Nordion Energi has been formed to drive the transition towards 100% green energy in Sweden, and it is a leader in the development of biogas and hydrogen related infrastructure in Sweden.

"Companies in the infrastructure sector with highly engaged employees experience a 21% increase in productivity and benefit from a 41% reduction in absenteeism compared to those with lower levels of engagement."

Höegh Evi's pioneering path in clean energy solutions

Höegh Evi is a leading global developer and operator of floating storage regasification units (FSRUs) with a fleet of nine vessels. Höegh Evi offers energy security to countries with a coastline and contracts are typically 10-15 year take-or-pay agreements with no exposure to volume or utilisation levels of the vessels. The Company is leading the development of multiple clean energy infrastructure solutions for ammonia, hydrogen and carbon capture & storage.

"Barriers to entry in the sector are very high. From a capital investment standpoint, a new-build FSRU costs over $400 million, while a conversion from an LNG carrier to an FSRU costs more than $200 million, on top of the value of the ship being converted."

Contact us

European Investor Relations::

IR@igneoip.com

Hamish Lea-Wilson is the Head of Europe and a Partner of Igneo Infrastructure Partners, based in London. He is a member of the EDIF II & III and GDIF Investment Committees.

Hamish currently sits on the board of directors of investee company Finerge. He has previously served on the board of investee companies Electricity North West, enfinium, and Scandlines.

Prior to joining the team in 2008, Hamish worked for PwC.

Hamish holds a Bachelor of Economics from the University of Durham.

Gregor Kurth is a Partner of Igneo Infrastructure Partners, based in London. He is and is a member of the EDIF II & III Investment Committees.

Gregor currently sits on the board of directors of investee companies DAH, MVV, Utilitas, and Westconnect. He has previously served on the board of investee companies Caruna, Digita, and Nordion.

Prior to joining the team in 2010, Gregor worked for 3i and Deutsche Bank.

Gregor holds an MSc in International Finance and Accounting from City University of London and a BSc in International Economics from Maastricht University.

Nick Grant is a Partner of Igneo Infrastructure Partners, based in London. He is a member of the EDIF II & III Investment Committees.

Nick currently sits on the board of directors of investee company Scandlines. He has previously served on the board of investee companies Coriance and enfinium.

Prior to joining the team in 2018, Nick was the CEO of Severn Trent Services in the UK, Ireland and Italy. Prior to this role, Nick held senior roles at Centrica PLC.

Nick holds an MBA from London Business School.