- A new study commissioned by Igneo Infrastructure Partners and conducted by Afi, demonstrates the appeal of the direct infrastructure asset class among institutional investors

- An analysis of returns found that Igneo’s first flagship European Diversified Infrastructure Fund has outperformed nearly all other asset classes, since 2009

- The asset class has been able to withstand global economic turbulence, higher interest rates and volatile inflation

MADRID AND LONDON, Tuesday, 4 February 2025 : Igneo Infrastructure Partners (‘Igneo’), a global infrastructure manager, together with Afi, a leading Spanish company that provides independent advice, consultancy and training in economics, finance and technology, have today published a whitepaper exploring the merits of the direct infrastructure asset class. The paper explores how proactive asset management of a portfolio of high-quality infrastructure businesses can be used as a tool to create sustainable value for investors as well as provide superior risk adjusted returns over the long-term.

The whitepaper features in-depth proprietary analysis, data from third-party sources, considers allocations across portfolios, performance, and the ability of the asset class to withstand economic shocks since 2009; the year Igneo launched their first flagship European Diversified Infrastructure Fund (‘EDIF I’) which reached maturity and was fully divested in 2024.

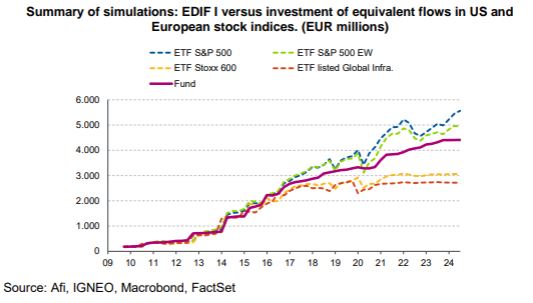

In an economic environment marked by higher interest rates and volatile levels of inflation, the paper demonstrates the case for direct infrastructure investment as an attractive alternative for investors seeking stability of returns, a good risk-adjusted return trade-off, and diversification of their overall portfolios. According to the Afi findings, the EDIF portfolio strongly outperformed comparable European and global listed equities over a 15-year time period.

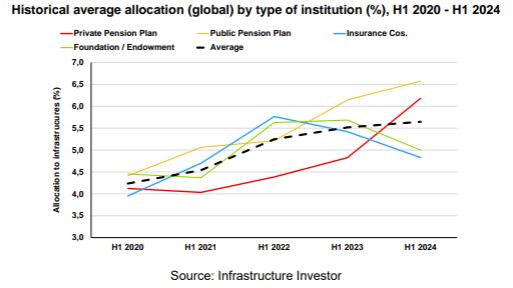

Rising share of institutional portfolios

Between 2020 and 2024, infrastructure managers have seen allocations across global institutional funds, such as pension plans and insurance firms, burgeon from an average of 4% to 5.5%, rising to nearly 7% in the first half of 2024, as set out in the following chart.

Outperformance against nearly every asset class

The paper modelled the performance of investing €2.0 billion from 2009 to 2024 across various asset classes. It found that Igneo’s EDIF I, as representative of European direct infrastructure, outperformed proxies representative of European equities by more than double, and almost quadruple that of global listed infrastructure, over the same time period.

Meanwhile, compared with other asset classes like US equities, the volatility of the asset class is approximately only one-third. Amid global economic uncertainty, this characteristic is particularly attractive for institutional investors, such as pension funds.

The paper also found the role of proactive asset management, which captures the operational and financial optimisation of assets, is crucial to the ability of the asset class to generate alpha and to mitigate risk.

Niall Mills, Managing Partner and Global Head at Igneo, commented: “We were delighted to partner with the team at Afi to provide empirical evidence in support of the infrastructure value proposition.

We have always firmly believed that a proactive asset management strategy applied via a buy and hold ownership philosophy is the optimal way to deliver best-in-class performance for our investors. This paper provides tangible evidence of how direct infrastructure has matured and outperformed against other asset classes with market-beating returns whilst remaining resilient in the face of global economic headwinds. In particular, it demonstrates the real value that can be created by the Igneo approach.

The case for infrastructure investment continues to grow as we look ahead to 2025 and beyond. The energy sector is undergoing significant change, with decarbonisation playing a key role, while at the same time, renewable energy sources and digital infrastructure are in huge demand due to the rapid acceleration of artificial intelligence. These themes mean there is a huge investment requirement for infrastructure globally and private capital will be essential in fulfilling this demand.”

José Manuel Amor Alameda, Managing Partner of Afi research division, commented: “This paper provides evidence of the role proactive asset management plays as an essential driver in creating value when investing in infrastructure assets. In an environment of structurally higher interest rates, the asset class will remain an attractive choice for investors seeking stability and consistency of returns.

We would like to thank Igneo for granting us access to historical performance data from EDIF I to allow us to produce this groundbreaking study and offer evidence of the benefits for investors in the asset class.”

Media enquiries

Lara Allen

Senior Communications Associate

E: Lara.allen@firstsentier.com

*Direct infrastructure is the term for the investment style of purchasing privately owned infrastructure businesses as opposed to those in listed markets.

About Igneo Infrastructure Partners

Igneo is an autonomous investment team in the First Sentier Group. It invests in high-quality, mature, mid-market infrastructure companies in renewables, digital infrastructure, waste management, water utilities and transportation / logistics sectors in the UK, Europe, North America, Australia and New Zealand. Operating since 1994, the team works closely with portfolio companies to create long-term sustainable value through innovation, a focus on ESG and proactive asset management.

Igneo manages US$22.9bn worth of assets (as at 30 September 2025) on behalf of more than 200 investors around the world.

About Afi Escuela

Afi is a leading Spanish company in independent advice, consultancy and training in economics, finance and technology. The company was founded in 1987 by a group of prominent academics and, since then, has become a benchmark in the provision of services and products for the financial sector. Our team consists of more than 250 highly qualified professionals, including more than twenty partners.

For more information, visit afi.es/en

Media Enquiries

Important information

This release is intended for information only, aimed solely at the media and should not be further distributed to individual and/or corporate investors, and financial advisers and/or distributors. The information included within this document and any supplemental documentation provided should not be copied, reproduced or redistributed without the prior written consent of First Sentier Group.

This document does not purport to be comprehensive or to give advice. This is not an offer document and does not constitute an offer or invitation or investment recommendation to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement.

The information contained within this document has been obtained from sources that we believe to be reliable and accurate at the time of issue but no representation or warranty, express or implied, is made as to the fairness, accuracy, or completeness of the information.

We communicate and conduct business through different legal entities in different locations